With a $209 billion gross domestic product (GDP)—placing it in the top third of U.S. metro areas—the St. Louis region continues to outperform peer cities in productivity and economic growth. Its

unmatched combination of workforce readiness, industrial space availability and excellent multimodal infrastructure continues to fuel the region’s position as a national leader in freight and industrial development.

This data is among the key information included in the 2025 St. Louis Regional Industrial Real Estate Market Indicators & Workforce Statistics Report. The report was released on June 6 by the St. Louis Regional Freightway during the final day of its annual FreightWeekSTL conference.

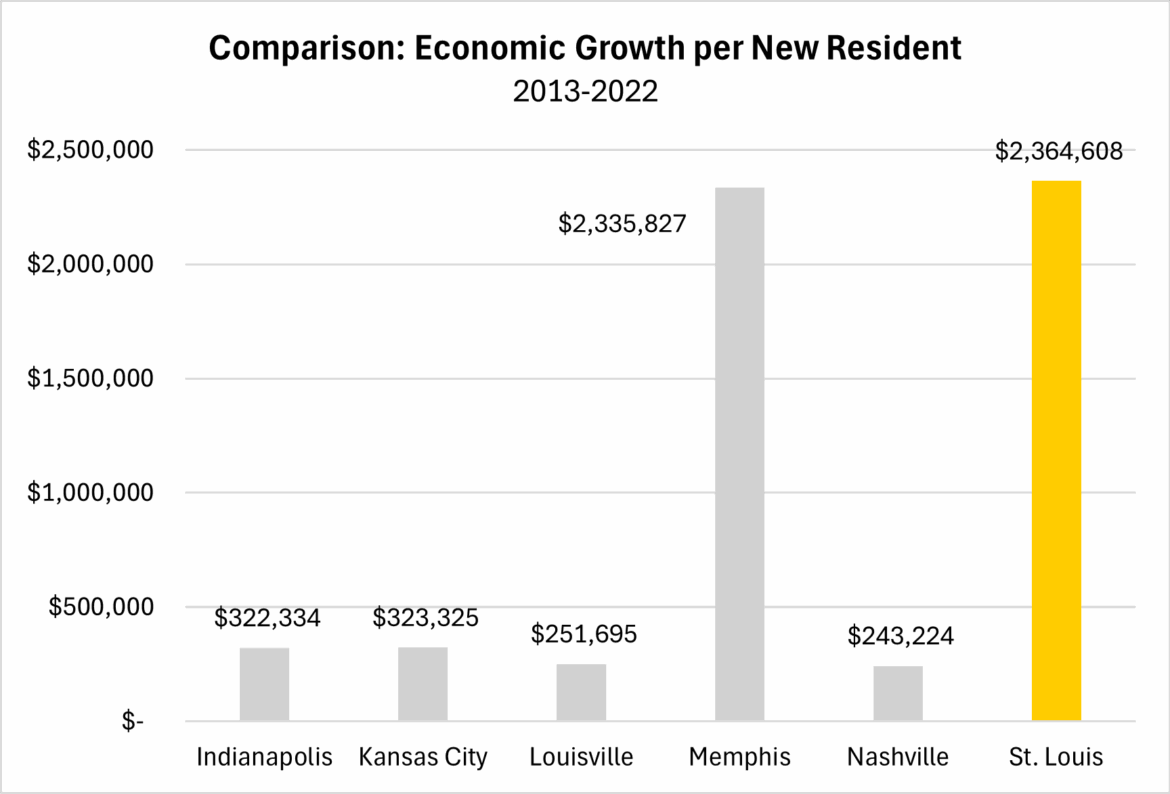

From 2020-2025, the GDP of St. Louis’ manufacturing industry and its distribution industry have both increased by a factor of 33%—underscoring St. Louis’ locational advantages for these industries. These statistics show that the region produces higher value goods per person than peer regions across the Midwest and they showcase the value proposition of the St. Louis regional manufacturing and distribution workforce. Analysis shows that over the past 10 years, for every new resident arriving in the St. Louis MSA, the overall economy added more than $2.3 million to its GDP. Workers in the St. Louis region are more productive in relation to workers in peer regions, making St. Louis a premiere location for businesses needing skilled labor proficient in the manufacturing and distribution of high-value complex goods.

“St. Louis continues to prove it’s not just a place to move goods—it’s a place to make them,” said Doug Rasmussen, Founder & CEO of Steadfast City Economic & Community Partners, which prepared the report. “The new report highlights the region’s strong competitive advantage in industrial and freight development, rooted in its ability to provide a high-productivity, high-value environment for companies that need an affordable, central location with a job-ready workforce, right-fit industrial manufacturing and distribution space, and strategic access to multimodal assets available across the region.” Additional competitive advantages highlighted in the report include:

Job Ready Labor Force

In terms of workforce readiness, the St. Louis region leads comparable metro regions in the Midwest in total number of workers, with a labor force size of 1.3 million. The region has a labor force participation rate of 65.2%, as well as a prime-age labor force participation rate (age 25-54) of 86.3%, both of which outpace the national rates. The St. Louis region also outperforms peer metro regions in the Midwest in terms of total number of Production and Transportation & Material Moving jobs—nearly 200,000— which fuel the productivity of the region’s target industry sectors.

Available Industrial Real Estate

The St. Louis region is a competitively sized and priced market in the central Midwest in terms of industrial inventory and rents. It offers highly competitive NNN asking rents, averaging $5.17 per square foot. The region currently has more has 193 million square feet of industrial space, with square footage under construction ticking up to nearly four million in the second quarter of 2025. This will add to the region’s existing inventory, which includes 323 properties with more than 100,000 sq ft, and 17 million square feet of total available space. Companies are taking notice and acting on the opportunity to expand and relocate in the St. Louis region, demonstrated by the region’s 11.1% year-over-year real estate tenant growth from 2024-2025 alone. Across the 11 submarkets in the bi-state St. Louis region, 17 new major national institutional grade owners entered the market in since 2024.

Strategic Geographic Location & Multimodal Infrastructure

The St. Louis region is the confluence of four major interstate highways (I-44, I-55, I-64 and I-70) and six Class I railroads, making it one of the largest rail centers in the United States. St. Louis Lambert International Airport serves 20 airlines and offers non-stop service to 68 cities, and MidAmerica St. Louis Airport in St. Clair County, Ill., recently expanded its terminal to meet increased demand. The region also is home to the nation’s most efficient inland port. These existing strategic advantages are supported by a demonstrated regional commitment to continued investment in multimodal infrastructure. The St. Louis Regional Freightway’s 2026 Priority Projects List includes 29 projects representing a total investment of nearly $8.9 billion. As of May 2025, more than $560 million in projects on the list had been completed and more than $2.6 billion in funding had been allocated for additional projects, with many of those under construction or soon to be. These numbers continue to grow year over year, improving the world-class freight network in the St. Louis region.

Growth in Targeted Industry Sectors

The report also highlights major investments in the organization’s targeted industry sectors, including recent project announcements in the Advanced Manufacturing, Chemicals, Food & AgTech, and Metals sectors totaling more than $3 billion in investment that is adding almost 2,000 new jobs in eastern Missouri and southwestern Illinois and helping to support the retention of hundreds more, while also creating more than 1,000 construction jobs. And those numbers don’t include previously reported investments in the Aerospace Manufacturing sector, which also is highlighted in the report. In the St. Louis region, Aerospace Manufacturing is a $5.1 billion industry contributing to economic vitality, with a job concentration that is 378% higher than the national average and

average annual wages that are 210% higher than average wages in the region. In 2024, the Freightway launched the Aerospace & Aviation Task Force, a collaboration between the region’s five busiest airports, leading employers in the aerospace manufacturing and service sector, and regional leaders in education and workforce training. This cross-cutting working group provides a platform for partners to strategically elevate this critical sector within the advanced manufacturing target industry, which supports more than 338,000 total jobs in the region.

“Recent investments and endeavors enhance the future competitiveness and connectivity of the bi-state St. Louis region and support future growth, particularly in targeted industry sectors such as aerospace, where this region already has distinct advantages,” said Mary Lamie, Executive Vice President of Multimodal Enterprises for Bi-State Development and head of the St. Louis Regional Freightway. “This report provides critical insights that further underscores the vitality of the region – and we encourage individuals to check out the report in its entirety.”

FreightWeekSTL 2025 was held June 2 through June 6. The week-long event featured virtual panel sessions with industry experts and leaders in freight, logistics and transportation and was presented by the St. Louis Regional Freightway. To learn more or to view any of the sessions from FreightWeekSTL 2025, visit FreightWeekSTL.com.